Python 官方文档:入门教程 => 点击学习

文章目录 LSTM 时间序列预测股票预测案例数据特征对收盘价(Close)单特征进行预测1. 导入数据2. 将股票数据收盘价(Close)进行可视化展示3. 特征工程4. 数据集制作5. 模型

利用前n天的数据预测第n+1天的数据。

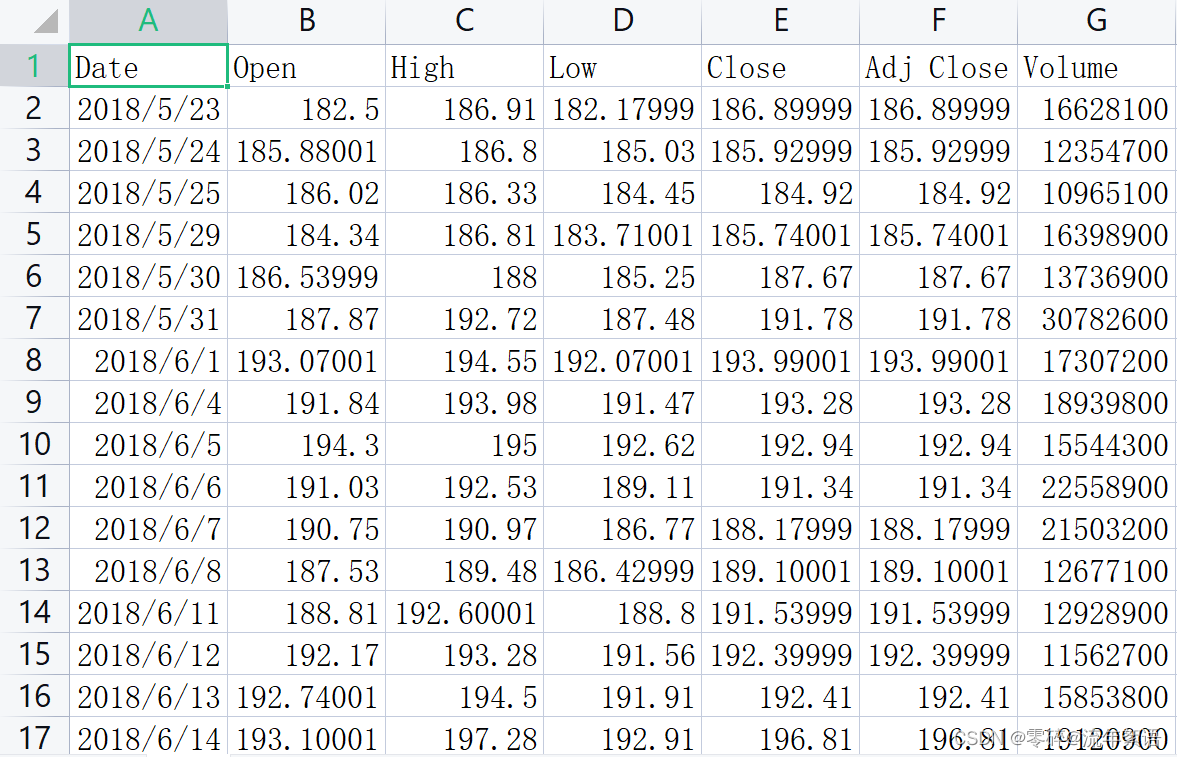

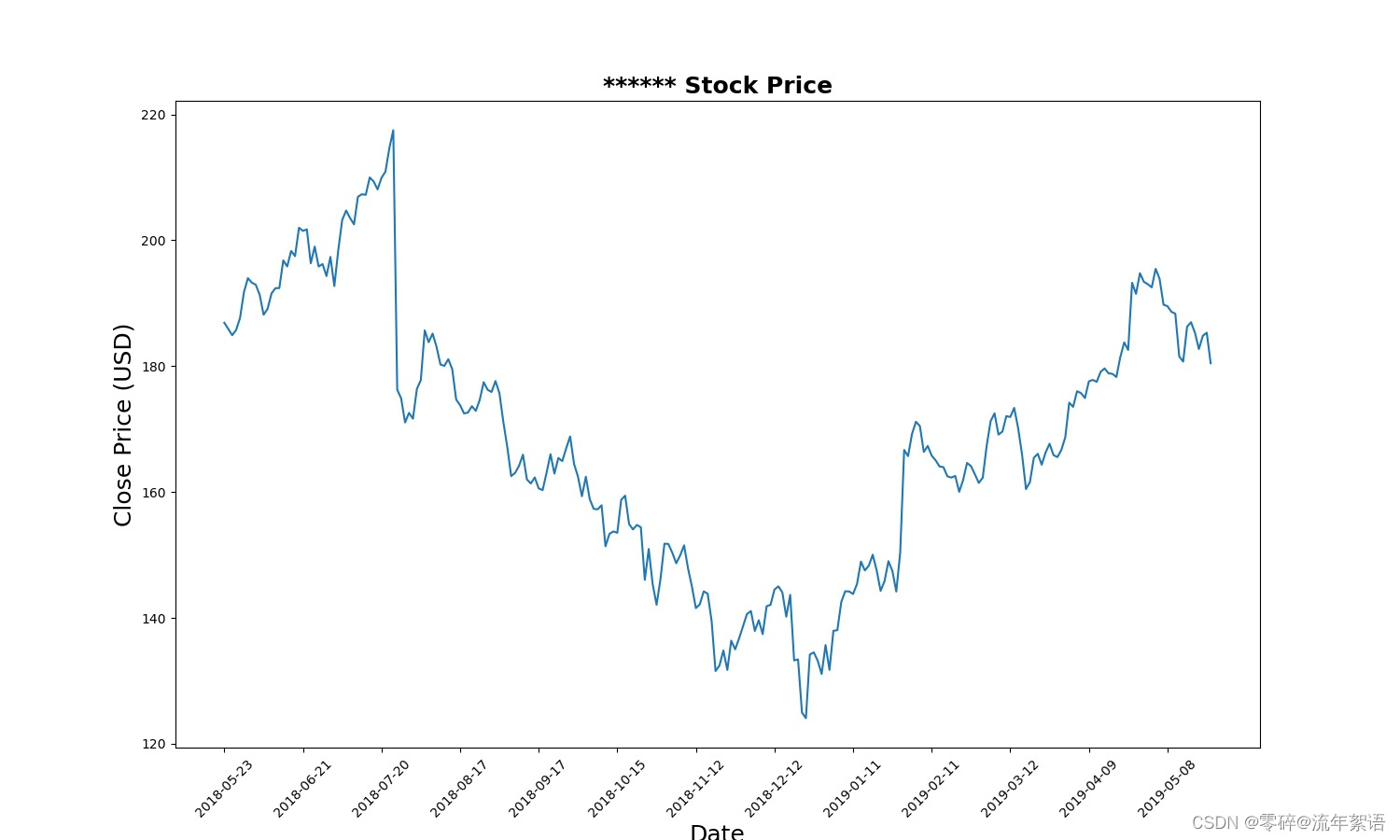

import numpy as npimport pandas as pdimport matplotlib.pyplot as pltimport seaborn as snsfrom sklearn.preprocessing import MinMaxScalerfilepath = 'D:/pythonProjects/LSTM/data/rlData.csv'data = pd.read_csv(filepath)# 将数据按照日期进行排序,确保时间序列递增data = data.sort_values('Date')# 打印前几条数据print(data.head())# 打印维度print(data.shape)# 设置画布大小plt.figure(figsize=(15, 9))plt.plot(data[['Close']])plt.xticks(range(0, data.shape[0], 20), data['Date'].loc[::20], rotation=45)plt.title("****** Stock Price", fontsize=18, fontweight='bold')plt.xlabel('Date', fontsize=18)plt.ylabel('Close Price (USD)', fontsize=18)plt.savefig('StockPrice.jpg')plt.show()

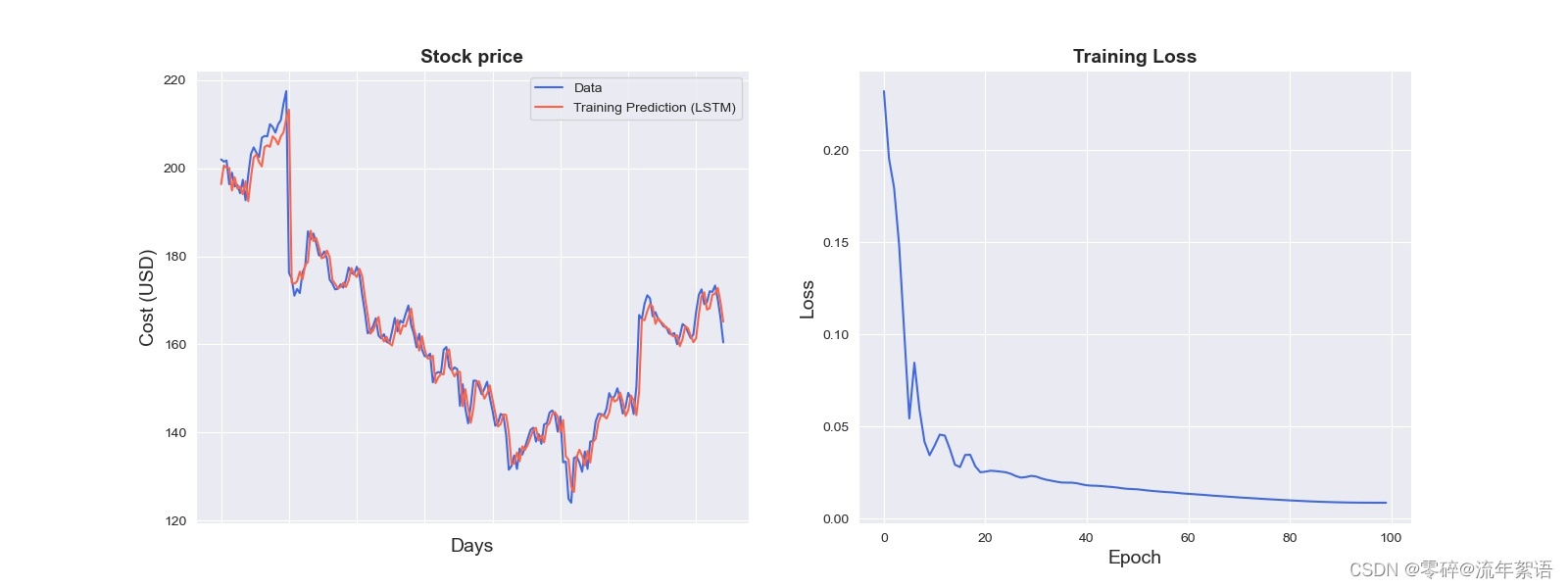

# 选取Close作为特征price = data[['Close']]# 打印相关信息print(price.info())打印结果如下:Int64Index: 252 entries, 0 to 251Data columns (total 1 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Close 252 non-null float64dtypes: float64(1)memory usage: 3.9 KBNone可以看出:price为DataFrame对象,以及其的结构和占用内存等信息 # 进行不同的数据缩放,将数据缩放到-1和1之间,归一化操作scaler = MinMaxScaler(feature_range=(-1, 1))price['Close'] = scaler.fit_transfORM(price['Close'].values.reshape(-1, 1))print(price['Close'].shape)打印结果如下:0 0.3450341 0.3242722 0.3026543 0.3202064 0.361515 ... 247 0.310788248 0.255565249 0.300514250 0.311216251 0.207192Name: Close, Length: 252, dtype: float64Int64Index: 252 entries, 0 to 251Series name: CloseNon-Null Count Dtype -------------- ----- 252 non-null float64dtypes: float64(1)memory usage: 3.9 KBNone(252,)可以看出:price['Close']的值,price['Close']为Series结构,price['Close']的结构为(252,) # 今天的收盘价预测明天的收盘价# lookback表示观察的跨度def split_data(stock, lookback):# 将stock转化为ndarray类型 data_raw = stock.to_numpy() data = [] # you can free play(seq_length) # 将data按lookback分组,data为长度为lookback的list for index in range(len(data_raw) - lookback): data.append(data_raw[index: index + lookback]) data = np.array(data); print(type(data)) # (232, 20, 1) # 按照8:2进行训练集、测试集划分 test_set_size = int(np.round(0.2 * data.shape[0])) train_set_size = data.shape[0] - (test_set_size) x_train = data[:train_set_size, :-1, :] y_train = data[:train_set_size, -1, :] x_test = data[train_set_size:, :-1] y_test = data[train_set_size:, -1, :] return [x_train, y_train, x_test, y_test]lookback = 20x_train, y_train, x_test, y_test = split_data(price, lookback)print('x_train.shape = ', x_train.shape)print('y_train.shape = ', y_train.shape)print('x_test.shape = ', x_test.shape)print('y_test.shape = ', y_test.shape)打印结果如下:x_train.shape = (186, 19, 1)y_train.shape = (186, 1)x_test.shape = (46, 19, 1)y_test.shape = (46, 1)import torchimport torch.nn as nnx_train = torch.from_numpy(x_train).type(torch.Tensor)x_test = torch.from_numpy(x_test).type(torch.Tensor)# 真实的数据y_train_lstm = torch.from_numpy(y_train).type(torch.Tensor)y_test_lstm = torch.from_numpy(y_test).type(torch.Tensor)y_train_gru = torch.from_numpy(y_train).type(torch.Tensor)y_test_gru = torch.from_numpy(y_test).type(torch.Tensor)# 输入的维度为1,只有Close收盘价input_dim = 1# 隐藏层特征的维度hidden_dim = 32# 循环的layersnum_layers = 2# 预测后一天的收盘价output_dim = 1num_epochs = 100class LSTM(nn.Module): def __init__(self, input_dim, hidden_dim, num_layers, output_dim): super(LSTM, self).__init__() self.hidden_dim = hidden_dim self.num_layers = num_layers self.lstm = nn.LSTM(input_dim, hidden_dim, num_layers, batch_first=True) self.fc = nn.Linear(hidden_dim, output_dim) def forward(self, x): h0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_() c0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_() out, (hn, cn) = self.lstm(x, (h0.detach(), c0.detach())) out = self.fc(out[:, -1, :]) return outmodel = LSTM(input_dim=input_dim, hidden_dim=hidden_dim, output_dim=output_dim, num_layers=num_layers)criterion = torch.nn.MSELoss()optimiser = torch.optim.Adam(model.parameters(), lr=0.01)import timehist = np.zeros(num_epochs)start_time = time.time()lstm = []for t in range(num_epochs): y_train_pred = model(x_train) loss = criterion(y_train_pred, y_train_lstm) print("Epoch ", t, "MSE: ", loss.item()) hist[t] = loss.item() optimiser.zero_grad() loss.backward() optimiser.step()training_time = time.time() - start_timeprint("Training time: {}".format(training_time))predict = pd.DataFrame(scaler.inverse_transform(y_train_pred.detach().numpy()))print(predict) # 预测值original = pd.DataFrame(scaler.inverse_transform(y_train_lstm.detach().numpy()))print(original) # 真实值打印结果如下:其中预测值每次运行可能会有一定的差距,但不影响最后的结果。torch.Size([186, 1])Epoch 0 MSE: 0.19840142130851746torch.Size([186, 1])Epoch 1 MSE: 0.17595666646957397torch.Size([186, 1])Epoch 2 MSE: 0.1369851976633072torch.Size([186, 1]).. ...Epoch 96 MSE: 0.008701297454535961torch.Size([186, 1])Epoch 97 MSE: 0.008698086254298687torch.Size([186, 1])Epoch 98 MSE: 0.008688708767294884torch.Size([186, 1])Epoch 99 MSE: 0.008677813224494457Training time: 3.884610414505005 00 196.6549991 201.0952912 200.1985633 200.4940034 195.120148.. ...181 171.398987182 171.508194183 172.992401184 169.850494185 165.566605[186 rows x 1 columns] 00 201.9999851 201.5000152 201.7400053 196.3500064 198.999985.. ...181 171.919998182 173.369995183 170.169998184 165.979996185 160.470001[186 rows x 1 columns]import seaborn as snssns.set_style("darkgrid")fig = plt.figure()fig.subplots_adjust(hspace=0.2, wspace=0.2)plt.subplot(1, 2, 1)ax = sns.lineplot(x = original.index, y = original[0], label="Data", color='royalblue')ax = sns.lineplot(x = predict.index, y = predict[0], label="Training Prediction (LSTM)", color='tomato')print(predict.index)print("aaaa")print(predict[0])ax.set_title('Stock price', size = 14, fontweight='bold')ax.set_xlabel("Days", size = 14)ax.set_ylabel("Cost (USD)", size = 14)ax.set_xticklabels('', size=10)plt.subplot(1, 2, 2)ax = sns.lineplot(data=hist, color='royalblue')ax.set_xlabel("Epoch", size = 14)ax.set_ylabel("Loss", size = 14)ax.set_title("Training Loss", size = 14, fontweight='bold')fig.set_figheight(6)fig.set_figwidth(16)plt.show()

实际上是对结果的总结及进一步说明。

import math, timefrom sklearn.metrics import mean_squared_error# make predictionsy_test_pred = model(x_test)# invert predictionsy_train_pred = scaler.inverse_transform(y_train_pred.detach().numpy())y_train = scaler.inverse_transform(y_train_lstm.detach().numpy())y_test_pred = scaler.inverse_transform(y_test_pred.detach().numpy())y_test = scaler.inverse_transform(y_test_lstm.detach().numpy())# calculate root mean squared errortrainScore = math.sqrt(mean_squared_error(y_train[:,0], y_train_pred[:,0]))print('Train Score: %.2f RMSE' % (trainScore))testScore = math.sqrt(mean_squared_error(y_test[:,0], y_test_pred[:,0]))print('Test Score: %.2f RMSE' % (testScore))lstm.append(trainScore)lstm.append(testScore)lstm.append(training_time)# shift train predictions for plottingtrainPredictPlot = np.empty_like(price)trainPredictPlot[:, :] = np.nantrainPredictPlot[lookback:len(y_train_pred)+lookback, :] = y_train_pred# shift test predictions for plottingtestPredictPlot = np.empty_like(price)testPredictPlot[:, :] = np.nantestPredictPlot[len(y_train_pred)+lookback-1:len(price)-1, :] = y_test_predoriginal = scaler.inverse_transform(price['Close'].values.reshape(-1,1))predictions = np.append(trainPredictPlot, testPredictPlot, axis=1)predictions = np.append(predictions, original, axis=1)result = pd.DataFrame(predictions)import plotly.express as pximport plotly.graph_objects as Gofig = go.Figure()fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[0], mode='lines', name='Train prediction')))fig.add_trace(go.Scatter(x=result.index, y=result[1], mode='lines', name='Test prediction'))fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[2], mode='lines', name='Actual Value')))fig.update_layout( xaxis=dict( showline=True, showgrid=True, showticklabels=False, linecolor='white', linewidth=2 ), yaxis=dict( title_text='Close (USD)', titlefont=dict( family='Rockwell', size=12, color='white', ), showline=True, showgrid=True, showticklabels=True, linecolor='white', linewidth=2, ticks='outside', tickfont=dict( family='Rockwell', size=12, color='white', ), ), showlegend=True, template = 'plotly_dark')annotations = []annotations.append(dict(xref='paper', yref='paper', x=0.0, y=1.05, xanchor='left', yanchor='bottom', text='Results (LSTM)', font=dict(family='Rockwell', size=26, color='white'), showarrow=False))fig.update_layout(annotations=annotations)fig.show()

import numpy as npimport pandas as pdimport matplotlib.pyplot as pltimport seaborn as snsfilepath = 'D:/PythonProjects/LSTM/data/rlData.csv'data = pd.read_csv(filepath)data = data.sort_values('Date')print(data.head())print(data.shape)sns.set_style("darkgrid")plt.figure(figsize=(15, 9))plt.plot(data[['Close']])plt.xticks(range(0, data.shape[0], 20), data['Date'].loc[::20], rotation=45)plt.title("****** Stock Price", fontsize=18, fontweight='bold')plt.xlabel('Date', fontsize=18)plt.ylabel('Close Price (USD)', fontsize=18)plt.show()# 1.特征工程# 选取Close作为特征price = data[['Close']]print(price.info())from sklearn.preprocessing import MinMaxScaler# 进行不同的数据缩放,将数据缩放到-1和1之间scaler = MinMaxScaler(feature_range=(-1, 1))price['Close'] = scaler.fit_transform(price['Close'].values.reshape(-1, 1))print(price['Close'].shape)# 2.数据集制作# 今天的收盘价预测明天的收盘价# lookback表示观察的跨度def split_data(stock, lookback): data_raw = stock.to_numpy() data = [] # print(data) # you can free play(seq_length) for index in range(len(data_raw) - lookback): data.append(data_raw[index: index + lookback]) data = np.array(data); test_set_size = int(np.round(0.2 * data.shape[0])) train_set_size = data.shape[0] - (test_set_size) x_train = data[:train_set_size, :-1, :] y_train = data[:train_set_size, -1, :] x_test = data[train_set_size:, :-1] y_test = data[train_set_size:, -1, :] return [x_train, y_train, x_test, y_test]lookback = 20x_train, y_train, x_test, y_test = split_data(price, lookback)print('x_train.shape = ', x_train.shape)print('y_train.shape = ', y_train.shape)print('x_test.shape = ', x_test.shape)print('y_test.shape = ', y_test.shape)# 注意:PyTorch的nn.LSTM input shape=(seq_length, batch_size, input_size)# 3.模型构建 —— LSTMimport torchimport torch.nn as nnx_train = torch.from_numpy(x_train).type(torch.Tensor)x_test = torch.from_numpy(x_test).type(torch.Tensor)y_train_lstm = torch.from_numpy(y_train).type(torch.Tensor)y_test_lstm = torch.from_numpy(y_test).type(torch.Tensor)y_train_gru = torch.from_numpy(y_train).type(torch.Tensor)y_test_gru = torch.from_numpy(y_test).type(torch.Tensor)# 输入的维度为1,只有Close收盘价input_dim = 1# 隐藏层特征的维度hidden_dim = 32# 循环的layersnum_layers = 2# 预测后一天的收盘价output_dim = 1num_epochs = 100class LSTM(nn.Module): def __init__(self, input_dim, hidden_dim, num_layers, output_dim): super(LSTM, self).__init__() self.hidden_dim = hidden_dim self.num_layers = num_layers self.lstm = nn.LSTM(input_dim, hidden_dim, num_layers, batch_first=True) self.fc = nn.Linear(hidden_dim, output_dim) def forward(self, x): h0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_() c0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_() out, (hn, cn) = self.lstm(x, (h0.detach(), c0.detach())) out = self.fc(out[:, -1, :]) return outmodel = LSTM(input_dim=input_dim, hidden_dim=hidden_dim, output_dim=output_dim, num_layers=num_layers)criterion = torch.nn.MSELoss()optimiser = torch.optim.Adam(model.parameters(), lr=0.01)# 4.模型训练import timehist = np.zeros(num_epochs)start_time = time.time()lstm = []for t in range(num_epochs): y_train_pred = model(x_train) loss = criterion(y_train_pred, y_train_lstm) print("Epoch ", t, "MSE: ", loss.item()) hist[t] = loss.item() optimiser.zero_grad() loss.backward() optimiser.step()training_time = time.time() - start_timeprint("Training time: {}".format(training_time))# 5.模型结果可视化predict = pd.DataFrame(scaler.inverse_transform(y_train_pred.detach().numpy()))original = pd.DataFrame(scaler.inverse_transform(y_train_lstm.detach().numpy()))import seaborn as snssns.set_style("darkgrid")fig = plt.figure()fig.subplots_adjust(hspace=0.2, wspace=0.2)plt.subplot(1, 2, 1)ax = sns.lineplot(x = original.index, y = original[0], label="Data", color='royalblue')ax = sns.lineplot(x = predict.index, y = predict[0], label="Training Prediction (LSTM)", color='tomato')# print(predict.index)# print(predict[0])ax.set_title('Stock price', size = 14, fontweight='bold')ax.set_xlabel("Days", size = 14)ax.set_ylabel("Cost (USD)", size = 14)ax.set_xticklabels('', size=10)plt.subplot(1, 2, 2)ax = sns.lineplot(data=hist, color='royalblue')ax.set_xlabel("Epoch", size = 14)ax.set_ylabel("Loss", size = 14)ax.set_title("Training Loss", size = 14, fontweight='bold')fig.set_figheight(6)fig.set_figwidth(16)plt.show()# 6.模型验证# print(x_test[-1])import math, timefrom sklearn.metrics import mean_squared_error# make predictionsy_test_pred = model(x_test)# invert predictionsy_train_pred = scaler.inverse_transform(y_train_pred.detach().numpy())y_train = scaler.inverse_transform(y_train_lstm.detach().numpy())y_test_pred = scaler.inverse_transform(y_test_pred.detach().numpy())y_test = scaler.inverse_transform(y_test_lstm.detach().numpy())# calculate root mean squared errortrainScore = math.sqrt(mean_squared_error(y_train[:,0], y_train_pred[:,0]))print('Train Score: %.2f RMSE' % (trainScore))testScore = math.sqrt(mean_squared_error(y_test[:,0], y_test_pred[:,0]))print('Test Score: %.2f RMSE' % (testScore))lstm.append(trainScore)lstm.append(testScore)lstm.append(training_time)# In[40]:# shift train predictions for plottingtrainPredictPlot = np.empty_like(price)trainPredictPlot[:, :] = np.nantrainPredictPlot[lookback:len(y_train_pred)+lookback, :] = y_train_pred# shift test predictions for plottingtestPredictPlot = np.empty_like(price)testPredictPlot[:, :] = np.nantestPredictPlot[len(y_train_pred)+lookback-1:len(price)-1, :] = y_test_predoriginal = scaler.inverse_transform(price['Close'].values.reshape(-1,1))predictions = np.append(trainPredictPlot, testPredictPlot, axis=1)predictions = np.append(predictions, original, axis=1)result = pd.DataFrame(predictions)import plotly.express as pximport plotly.graph_objects as gofig = go.Figure()fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[0], mode='lines', name='Train prediction')))fig.add_trace(go.Scatter(x=result.index, y=result[1], mode='lines', name='Test prediction'))fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[2], mode='lines', name='Actual Value')))fig.update_layout( xaxis=dict( showline=True, showgrid=True, showticklabels=False, linecolor='white', linewidth=2 ), yaxis=dict( title_text='Close (USD)', titlefont=dict( family='Rockwell', size=12, color='white', ), showline=True, showgrid=True, showticklabels=True, linecolor='white', linewidth=2, ticks='outside', tickfont=dict( family='Rockwell', size=12, color='white', ), ), showlegend=True, template = 'plotly_dark')annotations = []annotations.append(dict(xref='paper', yref='paper', x=0.0, y=1.05, xanchor='left', yanchor='bottom', text='Results (LSTM)', font=dict(family='Rockwell', size=26, color='white'), showarrow=False))fig.update_layout(annotations=annotations)fig.show()来源地址:https://blog.csdn.net/qq_44824148/article/details/126222872

--结束END--

本文标题: LSTM 时间序列预测+股票预测案例(Pytorch版)

本文链接: https://www.lsjlt.com/news/402689.html(转载时请注明来源链接)

有问题或投稿请发送至: 邮箱/279061341@qq.com QQ/279061341

下载Word文档到电脑,方便收藏和打印~

2024-03-01

2024-03-01

2024-03-01

2024-02-29

2024-02-29

2024-02-29

2024-02-29

2024-02-29

2024-02-29

2024-02-29

回答

回答

回答

回答

回答

回答

回答

回答

回答

回答

一口价域名售卖能注册吗?域名是网站的标识,简短且易于记忆,为在线用户提供了访问我们网站的简单路径。一口价是在域名交易中一种常见的模式,而这种通常是针对已经被注册的域名转售给其他人的一种方式。

一口价域名买卖的过程通常包括以下几个步骤:

1.寻找:买家需要在域名售卖平台上找到心仪的一口价域名。平台通常会为每个可售的域名提供详细的描述,包括价格、年龄、流

443px" 443px) https://www.west.cn/docs/wp-content/uploads/2024/04/SEO图片294.jpg https://www.west.cn/docs/wp-content/uploads/2024/04/SEO图片294-768x413.jpg 域名售卖 域名一口价售卖 游戏音频 赋值/切片 框架优势 评估指南 项目规模

0